What Does Bitcoin Breaking $64,000 Mean for the Crypto Market?

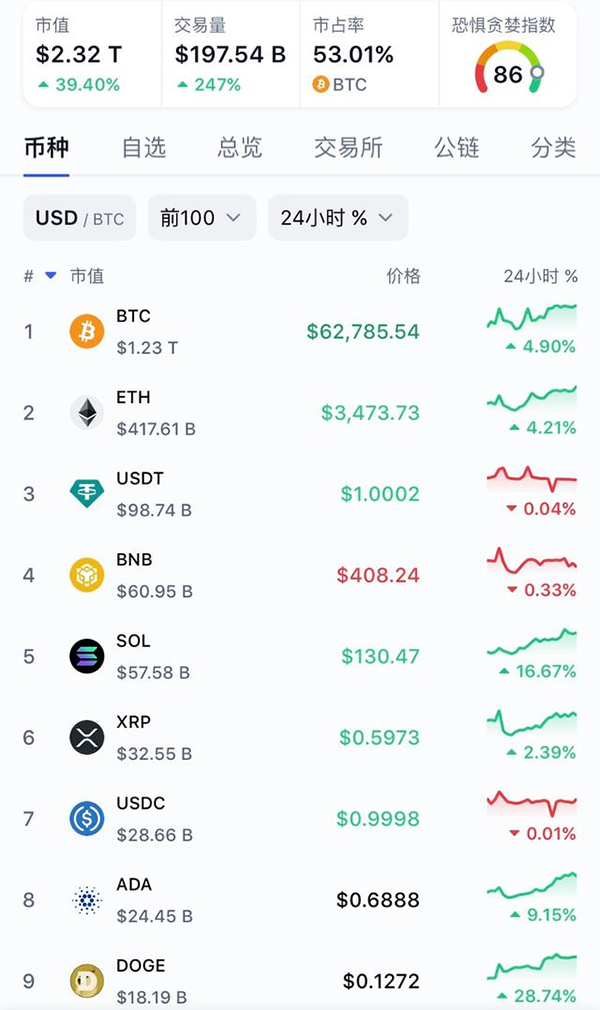

Beijing time on February 29, Bitcoin (BTC) price once exceeded 64,000 U.S. dollars, renewed since November 2021 new high, so far this month rose more than 50%, the total market value of Bitcoin was once close to 1.3 trillion U.S. dollars. As of around 10 p.m. yesterday, the price of bitcoin had fallen, hovering around $62,000.

Bitcoin's all-time high occurred on 10 November 2021, when it approached $69,000 at the time. Since then, Bitcoin has been on a downward spiral, dropping below $16,000 in November 2022, hitting the lowest point of the round of declines. Since then, the price of Bitcoin has rebounded, fluctuating around $30,000 until December 2023, when the price once again surpassed the $40,000 mark. since mid-February, the price of Bitcoin has accelerated, and is just one step away from its all-time high.

What is the impact of the Bitcoin market on the crypto market as a whole?

Beijing time since 28 February, bitcoin rose at the same time, ethereum (Ethereum), dog coins (DOGE) and other crypto assets rose during the same period.

As of the evening of 29 February, Bitcoin rose more than 4.9% in 24 hours, and Ether rose more than 4.2% in 24 hours.

Driven by Bitcoin's rise, the price of Dogcoin has soared, surging more than 28% in the past 24 hours, a gain that makes Dogcoin the leading percentage gain performer among major digital assets. Dogcoin is the ninth largest cryptocurrency and its market capitalisation is currently around $18 billion. At press time, Dogcoin was trading at $0.1268, its highest level since November 2022.

Second, the rise in Bitcoin's price could trigger a reallocation of funds. Some investors may shift some of the proceeds from Bitcoin to other digital assets with higher potential, such as investing in Bitcoin-related domain names. The following domains are for sale.