Domain market declines in 2023,but .AI drives countries/regions to grow fast

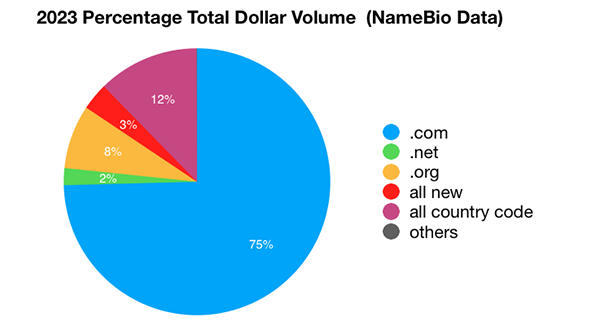

This report is based on 145,100 post-sale domain transactions recorded by NameBio in 2023, totaling just over $139 million. Compared to 2022, the dollar transaction volume in the domain market decreased by 21.2% in 2023. Not only did the dollar transaction volume decrease from the previous year, but 2023 was the second-lowest year in the past five, only surpassed by 2020, which had sales of $119 million. .COM sales contributed three-quarters of the domain revenue, showing that limiting domain investment to .com domains overlooks about 25% of the market. In 2023, 75% of the total dollar transaction volume came from the .com extension, as illustrated in the graph below.

While .com dominated sales in 2023, its share of sales decreased compared to 2022 when .com accounted for 81.4% of sales. In 2023, the dollar transaction share of country code extensions and .org both increased.

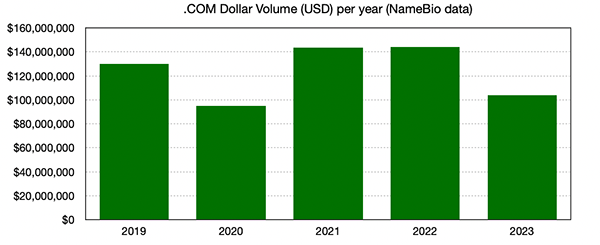

Compared to 2022, .COM sales in 2023 decreased by 27.9%.

The graph below illustrates the annual dollar transaction volume for .com. Although the situation in 2023 was slightly better than 2020 (which saw a sharp decline in the initial months of the global pandemic), it still lagged behind the other three years.

The pandemic shifted transactions to online, making 2021 and 2022 the best years for domain investment.

.NET

The .net extension performed slightly better than .com, but the dollar transaction volume in 2023 still decreased by 10.4% compared to 2022. It's worth noting that .net also declined by 25.4% in 2022.

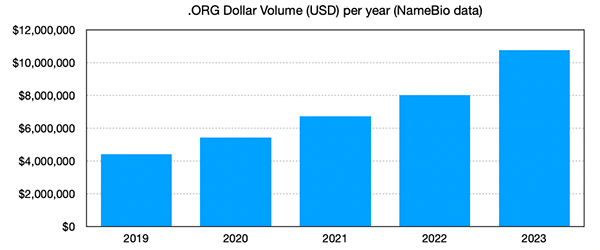

.ORG Shows the Most Stable Growth

The .org extension is experiencing moderate but steady growth, which continued in 2023. When comparing 2023 to 2022, .org sales increased by 34.4%. As shown below, the past five years have exhibited a consistent growth pattern.

In 2023, .org sales amounted to $10.8 million, far surpassing .net's $2.9 million.

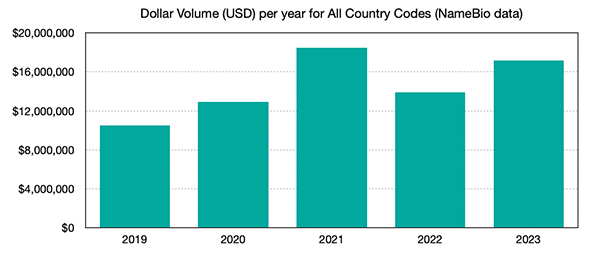

Country Code Extensions Perform Well in 2023

Country code extensions, supported by .io and .co, had a strong performance in 2020 and 2021 but faced a decline in 2022. However, in 2023, country code extensions saw an overall growth of 23.5%, with sales reaching $17.1 million compared to 2022. In the reported sales by NameBio in 2023, country code sales slightly exceeded $17.1 million.

Below, we present the five-year trend for country code extensions.

Leading Country Code Extensions

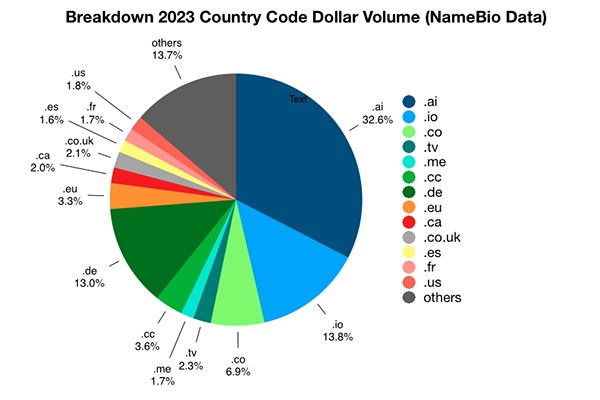

As expected, the .ai extension performed exceptionally well in 2023, with sales reaching nearly $5.6 million. While this number is more than seven times the previous year, it's essential to note that .ai has consistently been a robust country code, with sales exceeding $1 million in 2019, 2020, and 2021.

Although .ai accounted for almost one-third (32.6%) of all country code sales in 2023, there are several other strong performers, as shown in the graph below.

Only three country codes, .ai, .io, and .co, constitute more than half of all country code dollar transaction volume.

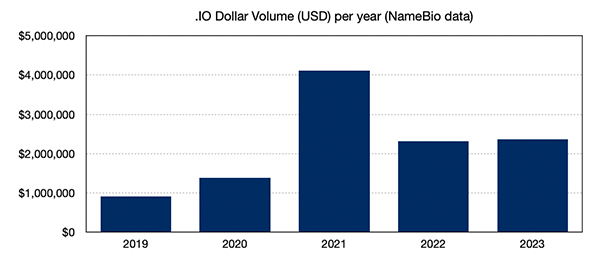

Compared to 2022, .io's dollar transaction volume increased by 1.9%, but it was significantly lower than in 2021.

While .co's sales decreased by 7.1% in 2023 compared to 2022, the decline was less than expected and smaller than .com's decline in 2023.

Here are the results for some other country code extensions I track:

- .de declined by 7.0% but remains at nearly $2.4 million, constituting 13% of all country code volume.

- .tv's dollar transaction volume decreased by 23.5% but still amounted to $389,000.

- .me remained relatively stable, with a modest 2.3% decrease in dollar transaction volume.

- .eu, which had been showing a slight increase in recent years, took a significant leap in 2023, nearly doubling its dollar transaction volume to just over $568,000.

- .cc experienced robust growth, rising from $352,000 in 2022 to slightly over $621,000 in 2023. It's important to note that almost all high-value sales in this extension involve numeric names.

- .co.uk contributed over $355,000 in 2023 but saw a 30% decrease compared to 2022. .uk experienced a smaller decline of 5.3%, but the volume was much lower.

- .us, after strong growth in 2022, gave back most of it in 2023, with a 15.4% decrease in dollar transaction volume. .us's dollar transaction volume in 2023 was slightly below $315,000.

- .vc, the domain extension associated with venture capital, had a challenging year, with a nearly 18% decrease in sales, totaling $197,000 in 2023.

- After a significant drop, .to, the Tonga country code, declined by 82%. This may be related to disruptions from the main registrar after the CEO's death. It's worth noting that 2022 was an exceptionally strong year for .to.

- .fr, the French country code, remains a robust extension, valued at $289,000, but it declined by 28.1%.

- The situation for .ch, the Swiss country code, is similar, with a 22% decline in 2023, but the transaction volume is close to $227,000.

- .es, the Spanish country code, showed strong performance in 2023, with a 68% growth in sales.

- Both .com.au and .ca, the country codes for Australia and Canada, respectively, saw significant growth, with .com.au increasing nearly fourfold to $118,000 and .ca rising by 79% to $343,000.

- The .gg extension, popular in the gaming community, experienced a decline of more than half from an already sluggish numeric base.

- In 2023, .in, the country code for India, had a transaction volume of $137,000, but it declined by over 60% compared to 2022. Higher expectations may have been held for the strong-growing economy.

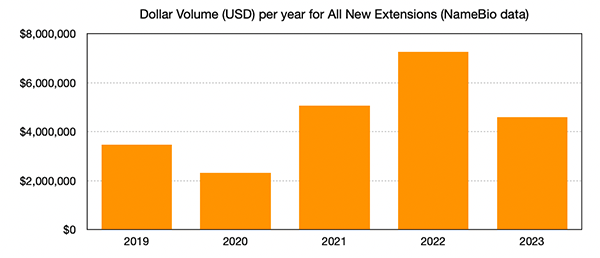

New Top-Level Domains (TLDs)

Overall, aftermarket sales for new TLDs decreased by almost 37%, totaling just under $4.6 million. Below, I present the trends over the past five years.

While the dollar transaction volume for .xyz in 2023 was close to $1.4 million, it decreased by approximately 69%. .xyz accounts for almost 30% of the total new gTLD volume.

Sales for the .app extension increased by 53%, reaching $669,000 in 2023, representing 14.6% of all new extension sales.

In terms of registrations and post-market sales, .online had a strong showing in 2023, skyrocketing from about $20,000 in the previous year to

$451,000 in dollar transaction volume. Given that most strong names are registered at premium prices, and these sales are often not reported, this volume only represents a small portion of .online sales records.

I had not paid much attention to .vip, so I was surprised when the analysis showed it accounted for 7.7% of the total new gTLD aftermarket sales in 2023. Its sales, both in volume and average value, reached $352,000, showing robust growth in 2023.

Another surprising performer was .law, with sales significantly increasing to a total of $127,000. As this extension is limited to use by legal professionals, institutions, and organizations, it warrants careful consideration as an investment.

The .tech extension saw a substantial increase in transaction volume, slightly exceeding $61,000 in 2023, compared to around $36,000 in 2022.

Although .life and .live continued to maintain some transaction volume in 2023, both saw significant decreases. The .link extension had a slight increase, but sales in the post-market in 2023 were very limited, just over $25,000.

Due to robust pricing, the dollar transaction volume for .cloud surged in 2023 to $126,000, increasing to about four times the previous year's volume. Considering the applicability of AI-driven cloud services, this extension may be one to watch.

For similar reasons, .network may have potential, with a 15% increase in dollar transaction volume in 2023, although the total amount for the year is still below $43,000.

The .art extension saw an increase in 2022 but declined somewhat in 2023, with sales decreasing by 35% to just under $225,000. Most aftermarket sales for heavily discounted extensions are negligible. For example, a single sale of .cfd was priced below $1,000, .icu had only four sales totaling about $1,000, and .top had only ten sales totaling about $2,000. It should be noted that compared to previous years, more new extensions had at least one or several four-figure aftermarket sales. There were also significant outlier sales, such as the $79,000 sale of 789.win entering the top 100 sales for 2023 or the large de.fi sale, which was the highest sale in 2023.