Global TLD market report out, .com 45 per cent, ccTLD 38 per cent

The latest report from the Council of European National Top-Level Domain Registries (CENTR) has been released. It covers the global status and registration trends of all top-level domains (traditional gTLDs, new gTLDs, and ccTLDs), with a particular focus on the European ccTLD market. The report also includes an analysis and forecast of broader technical and social forces that may affect domain registrations in 2024 and beyond.

Key points from the report:

- In the first half of 2023, domain growth for European ccTLDs showed signs of recovery from a record-low at the beginning of the year, reaching a peak of 2.2% by September. However, the median annual growth rate for the 30 largest ccTLDs in the region was 1.4%.

- The demand ratio averaged 1.1, meaning there were more domains registered on average than deleted domains.

- Based on locally registered domains, European ccTLDs are expected to have approximately 54% market share.

- In 2023, the median price for registrars purchasing European ccTLDs decreased to 9.4 euros. The same registrars sold .com domains for 12.5 euros.

- The adoption rate of DNSSEC is 10.5% and continues to grow steadily.

- The proportion of websites using SSL is becoming increasingly stable, reaching 77% recently.

Global Market Dynamics:

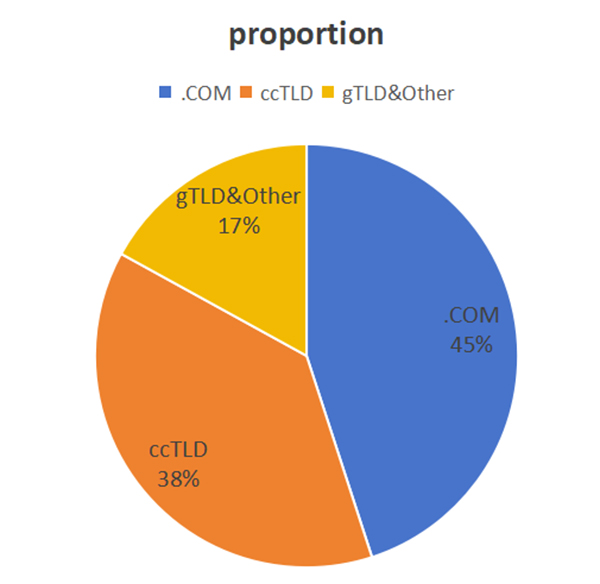

- The global market is estimated to have 3.6 to 3.7 billion domain names, covering 1,456 recorded TLDs. Their distribution is roughly as follows: 45% allocated to .com, 38% to ccTLDs, and the remaining distributed among all other gTLDs.

- The median growth rate for the top 300 TLDs (Global300) is 2.6% (as of July 2023).

- In generic top-level domains (gTLDs), the median growth rate for the top 300 is 1.2%, and for the top 100, it is 5.1%. Although the growth rate for the top 100 is higher, the median renewal rate is 65%, down 4% compared to the previous year.

- The growth of the world's largest top-level domain, .com, has stagnated due to a long-term increase in deletion rates and a decrease in new registration rates.

- As of the end of 2022, the long-term deletion rate exceeded the equivalent new registration rate for the first time in at least a decade. This trend may be partly due to an increase in low-content domains within .com in 2022 and 2023. This proportion has stabilized in recent months.

- The top-performing generic top-level domains (gTLDs) in terms of growth rate over the 12 months ending in July 2023 include: .cfd, .bond, .lol, .sbs, and .pics.

- In "geographic" generic top-level domains (gTLDs), the number of domains managed remains low, and over the 12 months ending in July 2023, most domain growth has been limited or has seen contraction.